Demand in the frozen desserts and pastries category has shifted from the traditional family-shared dessert to single-serve and bite-sized sweets according to Retail World’s category review in their August 22 issue.

Demand in the frozen desserts and pastries category has shifted from the traditional family-shared dessert to single-serve and bite-sized sweets according to Retail World’s category review in their August 22 issue.

Some trends and predictions mentioned are that dessert shoppers have become more knowledgeable and are checking ingredients, switching to healthier options such as all-natural, functional, low-fat, and low-calorie products, Retail Safari’s General Manager Retail Activation Lynne McKay said.

Nanna’s Brand Manager Hannah Audas pointed out that “in a category that primarily provides larger-format sweets, there is a trend toward sweet treats and snacking”. Lynne McKay added that the growth of the time-poor consumer has resulted in an increase in the frequency of snacking. Consumers are choosing smaller and multi-pack products as well as meal solutions that won’t have them cooking (or eating desserts!) until midnight. This tendency caters for smaller households and time poor shoppers looking for convenient sweet treats with portion control. It also suggests an increase in fragmented eating occasions.

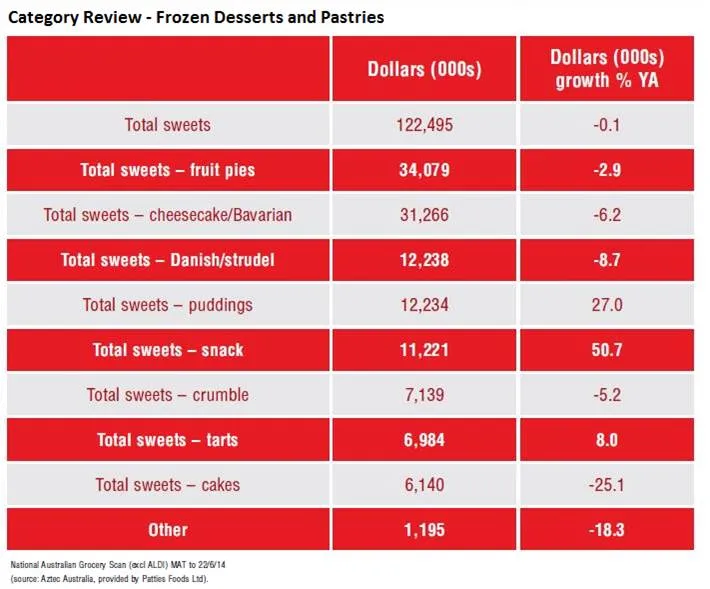

Patties Foods Ltd has reported that the category is fairly flat year on year, with puddings and snack segments attracting the greatest growth. Frozen fruit and sweets have a grocery value of $220.4 million, encompassing three segments: frozen fruit ($90.3 million value), hot desserts ($72.2 million) and cold desserts ($57.8 million). McCain, Patties and private label are the top shareholders and Sara Lee, McCain Seasons, Nanna’s and Creative Gourmet the major brands.

Read more at Savouring sweet growth from treats